FXGlory Ltd

Well-known member

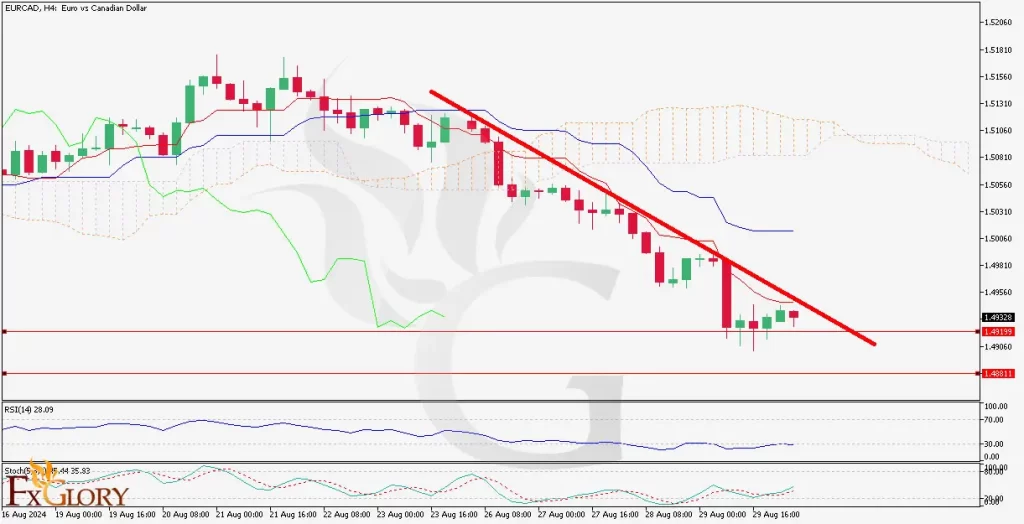

EURCAD analysis for 04.01.2023

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EURCAD currency pair, represented in the H4 timeframe, is influenced by various economic factors. The Euro is affected by the European Central Bank's policy decisions, economic data releases from the Eurozone, and political stability within the EU. The Canadian Dollar is swayed by commodity prices, particularly oil, due to Canada's status as a major exporter. Trade relationships, economic indicators, and geopolitical events within and between the Eurozone and Canada are crucial for traders to monitor, as they can cause significant volatility in this pair.

Price Action:

The EURCAD chart shows a period of consolidation with a slight bearish bias, as indicated by the recent lower highs and lower lows. The market seems to be in a phase of indecision, with the candles trading within a narrow range, suggesting a tug-of-war between buyers and sellers.

Key Technical Indicators:

Ichimoku: The price is trading below the Ichimoku cloud, signaling a bearish trend. The cloud acts as a dynamic resistance.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line and close to the zero line, indicating a weak bearish momentum.

RSI (Relative Strength Index): The RSI is at 43.17, suggesting a lack of strong momentum in either direction and a potential for sideways movement.

Volumes: The volume is showing spikes below the candlesticks, indicating periods of increased trading activity that correspond with larger price movements.

Support and Resistance:

Support: The recent low around the 1.4550 level is acting as a support zone.

Resistance: The 1.4700 level, close to the Ichimoku cloud, is serving as the immediate resistance.

Conclusion and Consideration:

The EURCAD pair on the H4 timeframe is currently displaying bearish signals with the price below the Ichimoku cloud and the MACD below its signal line. However, the lack of strong bearish momentum suggested by the RSI indicates that the pair may continue to consolidate. Traders should keep an eye on fundamental factors affecting both currencies, including economic releases and oil price changes. It's also important to watch for a potential break out of the current price range. Risk management strategies should be applied when considering entry and exit points around the identified support and resistance levels.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Trading involves risks and it is recommended to perform your own analysis before making any trading decisions.

FXGlory

04.01.2023

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EURCAD currency pair, represented in the H4 timeframe, is influenced by various economic factors. The Euro is affected by the European Central Bank's policy decisions, economic data releases from the Eurozone, and political stability within the EU. The Canadian Dollar is swayed by commodity prices, particularly oil, due to Canada's status as a major exporter. Trade relationships, economic indicators, and geopolitical events within and between the Eurozone and Canada are crucial for traders to monitor, as they can cause significant volatility in this pair.

Price Action:

The EURCAD chart shows a period of consolidation with a slight bearish bias, as indicated by the recent lower highs and lower lows. The market seems to be in a phase of indecision, with the candles trading within a narrow range, suggesting a tug-of-war between buyers and sellers.

Key Technical Indicators:

Ichimoku: The price is trading below the Ichimoku cloud, signaling a bearish trend. The cloud acts as a dynamic resistance.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line and close to the zero line, indicating a weak bearish momentum.

RSI (Relative Strength Index): The RSI is at 43.17, suggesting a lack of strong momentum in either direction and a potential for sideways movement.

Volumes: The volume is showing spikes below the candlesticks, indicating periods of increased trading activity that correspond with larger price movements.

Support and Resistance:

Support: The recent low around the 1.4550 level is acting as a support zone.

Resistance: The 1.4700 level, close to the Ichimoku cloud, is serving as the immediate resistance.

Conclusion and Consideration:

The EURCAD pair on the H4 timeframe is currently displaying bearish signals with the price below the Ichimoku cloud and the MACD below its signal line. However, the lack of strong bearish momentum suggested by the RSI indicates that the pair may continue to consolidate. Traders should keep an eye on fundamental factors affecting both currencies, including economic releases and oil price changes. It's also important to watch for a potential break out of the current price range. Risk management strategies should be applied when considering entry and exit points around the identified support and resistance levels.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Trading involves risks and it is recommended to perform your own analysis before making any trading decisions.

FXGlory

04.01.2023