HFM

Well-known member

Date: 4th June 2024.

The Euro Declines As The ECB's Rate Decision Approaches!

Trading Leveraged Products is risky

*The EURUSD retreats from recent highs and gains strong indications from momentum indicators. The Euro also declines against the Japanese Yen.

Stocks decline in Tuesday's pre-trading session, but will lower oil prices soon prompt a new surge of buyers?

*The US economy shows signs of slowing, but analysts advise no recession while employment remains strong.

*Chip-makers save the NASDAQ from witnessing a strong decline on Monday. NVIDIA rises 4.90% and Micron Technology 2.54%.

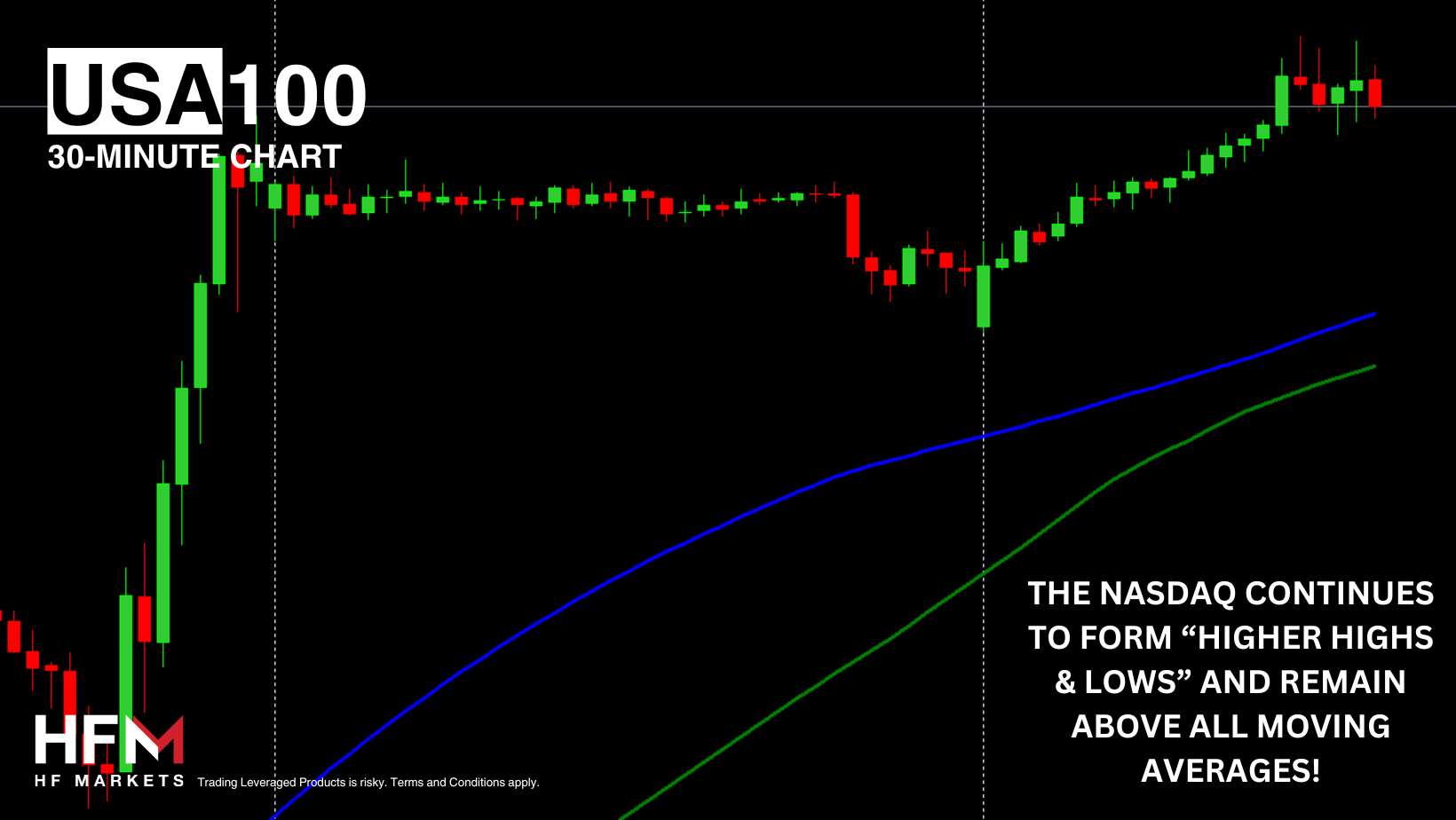

USA100 – NVIDIA Saves the NASDAQ From Another Decline!

The NASDAQ saw prices increasing throughout the day but fell within the first 4 hours of the US session. However, like Friday, investors re-entered the market at the lower price in the second half of the session. As a result, the NASDAQ ended the day 0.47% higher, but this was largely due to good performance from NVIDIA stocks which rose more than 4.90%. According to Wall Street, without NVIDIA, the NASDAQ would most likely have ended lower. NVIDIA is currently the fourth most influential company amongst the NASDAQ's components.

The latest news which is holding investor attention is the latest Purchasing Managers Index, which is one of the few leading indicators. Other economic data are known as laggings as they are based on past data rather than sentiment and future outlook. The ISM Manufacturing PMI and Manufacturing Prices both read lower than expectations and lower than the previous month. However, investors should not necessarily "overreact" as analysts advise this would not mean anything unless employment also contracts. Additionally, the Final Manufacturing PMI read 51.3 which still indicates economic expansion, and the lower oil prices can support stocks in the longer term.

A slight decline is not necessarily negative for the stock market as long as there is not a higher risk of a recession. The lower consumer demand and economic activity could prompt the Federal Reserve to consider more than 1 rate cut in 2024. 53.0% of large traders are betting on this, up from 49.0% before the publication of the statistics. Additionally, most experts predict that the regulators will cut the interest rate twice over the course of the year, totalling 0.50%.

Nonetheless, technical analysis indicates there is still the possibility of the price declining. The price was unable to remain above the main sentiment lines and did not form a higher high. At the moment, the RSI is currently priced at 50.30 which indicates the price may witness a reverting price condition.

If the price rises to a new high breaking above $18,638.50, the momentum could indicate upward price movement again. Otherwise, bearish crossovers on the 5-minute chart will continue to indicate valid downward momentum. Currently, European stocks are declining and if they keep falling, investors can use this as an indication of a risk-off sentiment.

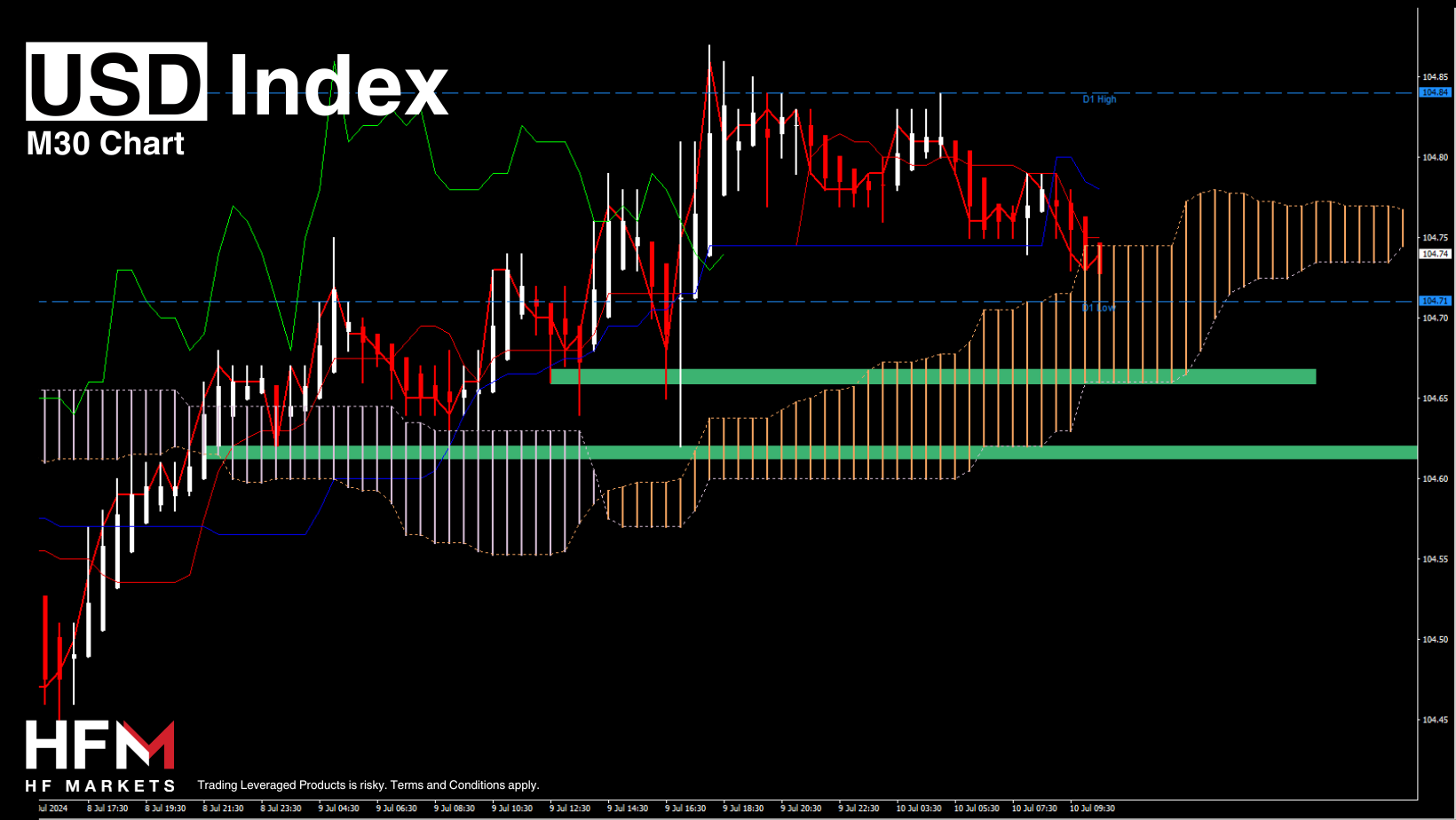

EURUSD – The Euro Gives Up Gains As The ECB's Rate Decision Approaches

The price of the EURUSD continues to form higher highs and higher lows but is currently trading within a downward price movement. If the price declines below 1.08576, the bullish trend pattern will be broken. Investors are currently contemplating the timing of the European Central Bank's first interest rate cut.

The EU Manufacturing PMI rose from 45.7 points to 47.3 points, and the German PMI from 42.5 points to 45.4 points, justifying preliminary estimates. Experts believe that the European economy is gradually recovering but sustainable growth has not yet been achieved. On Thursday, the European Central Bank will make a decision on its policy: according to forecasts, regulator officials will reduce the interest rate from 4.50% to 4.25%, the deposit rate from 4.00% to 3.75%, and the marginal rate from 4.75% to 4.50%.

The EURUSD is seeing indications of upward price movement on the 2-hour timeframe, but so far is declining against most currencies. In addition to this, the price is witnessing strong bearish momentum and bearish indication on the 5-minute chart. Therefore, the current signals point towards a short-term bias. However, if the momentum continues investors may revisit this outlook and consider a full correction.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

The Euro Declines As The ECB's Rate Decision Approaches!

Trading Leveraged Products is risky

*The EURUSD retreats from recent highs and gains strong indications from momentum indicators. The Euro also declines against the Japanese Yen.

Stocks decline in Tuesday's pre-trading session, but will lower oil prices soon prompt a new surge of buyers?

*The US economy shows signs of slowing, but analysts advise no recession while employment remains strong.

*Chip-makers save the NASDAQ from witnessing a strong decline on Monday. NVIDIA rises 4.90% and Micron Technology 2.54%.

USA100 – NVIDIA Saves the NASDAQ From Another Decline!

The NASDAQ saw prices increasing throughout the day but fell within the first 4 hours of the US session. However, like Friday, investors re-entered the market at the lower price in the second half of the session. As a result, the NASDAQ ended the day 0.47% higher, but this was largely due to good performance from NVIDIA stocks which rose more than 4.90%. According to Wall Street, without NVIDIA, the NASDAQ would most likely have ended lower. NVIDIA is currently the fourth most influential company amongst the NASDAQ's components.

The latest news which is holding investor attention is the latest Purchasing Managers Index, which is one of the few leading indicators. Other economic data are known as laggings as they are based on past data rather than sentiment and future outlook. The ISM Manufacturing PMI and Manufacturing Prices both read lower than expectations and lower than the previous month. However, investors should not necessarily "overreact" as analysts advise this would not mean anything unless employment also contracts. Additionally, the Final Manufacturing PMI read 51.3 which still indicates economic expansion, and the lower oil prices can support stocks in the longer term.

A slight decline is not necessarily negative for the stock market as long as there is not a higher risk of a recession. The lower consumer demand and economic activity could prompt the Federal Reserve to consider more than 1 rate cut in 2024. 53.0% of large traders are betting on this, up from 49.0% before the publication of the statistics. Additionally, most experts predict that the regulators will cut the interest rate twice over the course of the year, totalling 0.50%.

Nonetheless, technical analysis indicates there is still the possibility of the price declining. The price was unable to remain above the main sentiment lines and did not form a higher high. At the moment, the RSI is currently priced at 50.30 which indicates the price may witness a reverting price condition.

If the price rises to a new high breaking above $18,638.50, the momentum could indicate upward price movement again. Otherwise, bearish crossovers on the 5-minute chart will continue to indicate valid downward momentum. Currently, European stocks are declining and if they keep falling, investors can use this as an indication of a risk-off sentiment.

EURUSD – The Euro Gives Up Gains As The ECB's Rate Decision Approaches

The price of the EURUSD continues to form higher highs and higher lows but is currently trading within a downward price movement. If the price declines below 1.08576, the bullish trend pattern will be broken. Investors are currently contemplating the timing of the European Central Bank's first interest rate cut.

The EU Manufacturing PMI rose from 45.7 points to 47.3 points, and the German PMI from 42.5 points to 45.4 points, justifying preliminary estimates. Experts believe that the European economy is gradually recovering but sustainable growth has not yet been achieved. On Thursday, the European Central Bank will make a decision on its policy: according to forecasts, regulator officials will reduce the interest rate from 4.50% to 4.25%, the deposit rate from 4.00% to 3.75%, and the marginal rate from 4.75% to 4.50%.

The EURUSD is seeing indications of upward price movement on the 2-hour timeframe, but so far is declining against most currencies. In addition to this, the price is witnessing strong bearish momentum and bearish indication on the 5-minute chart. Therefore, the current signals point towards a short-term bias. However, if the momentum continues investors may revisit this outlook and consider a full correction.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.