FXOpen Trader

Well-known member

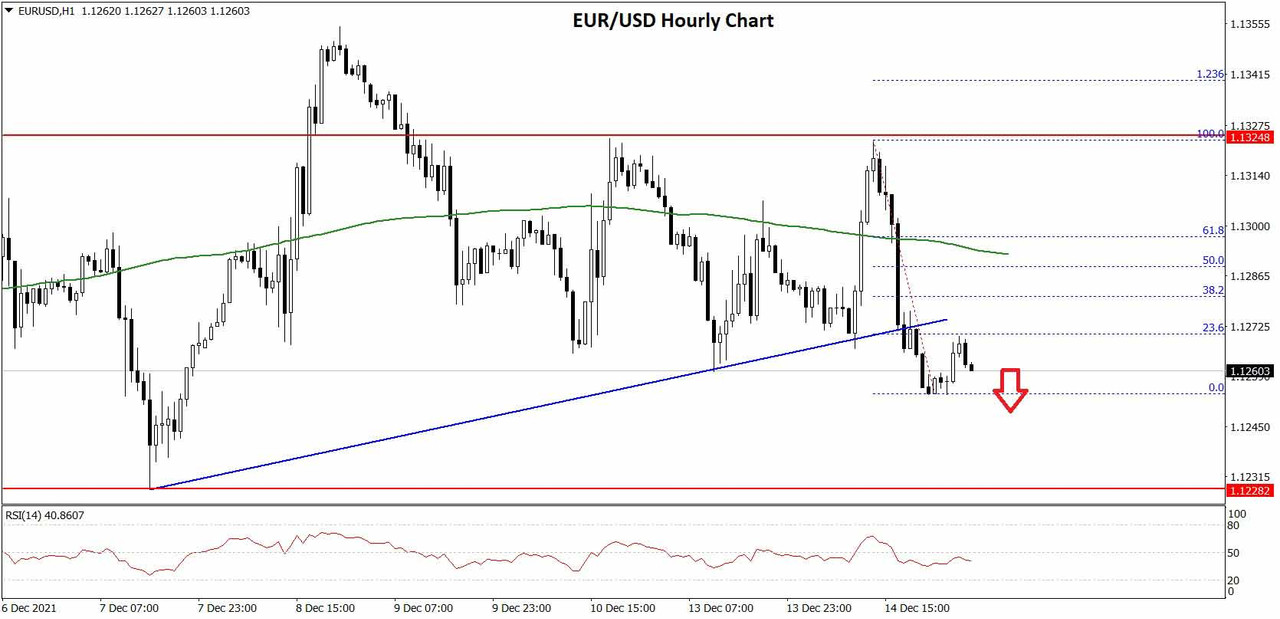

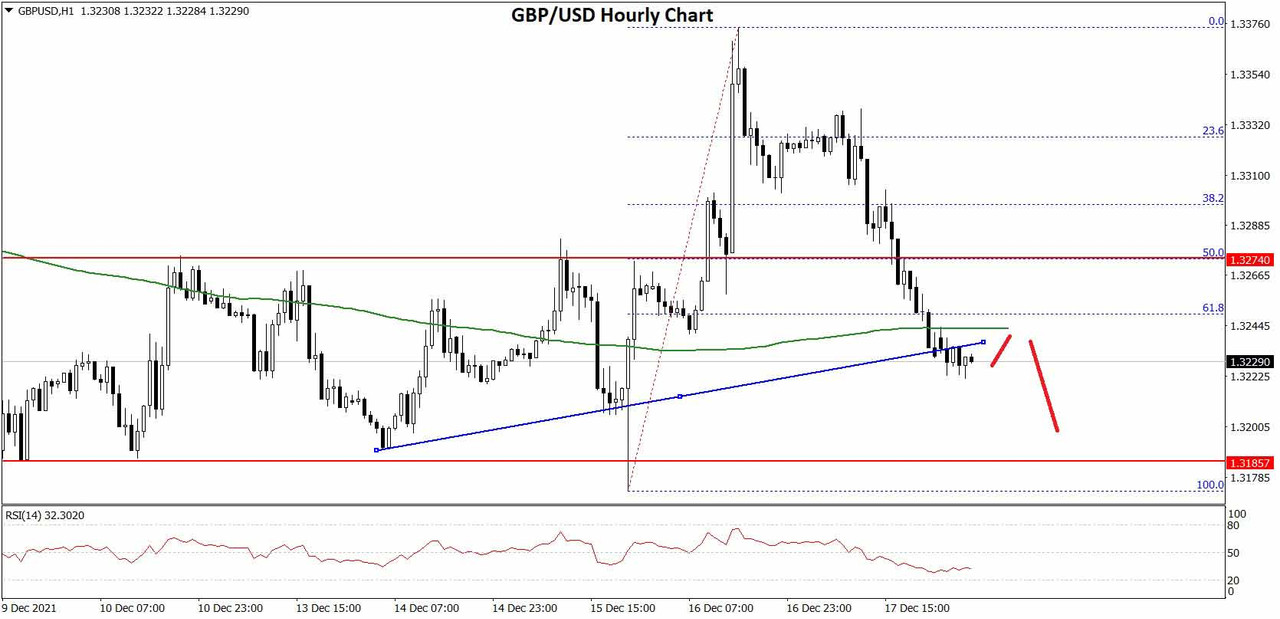

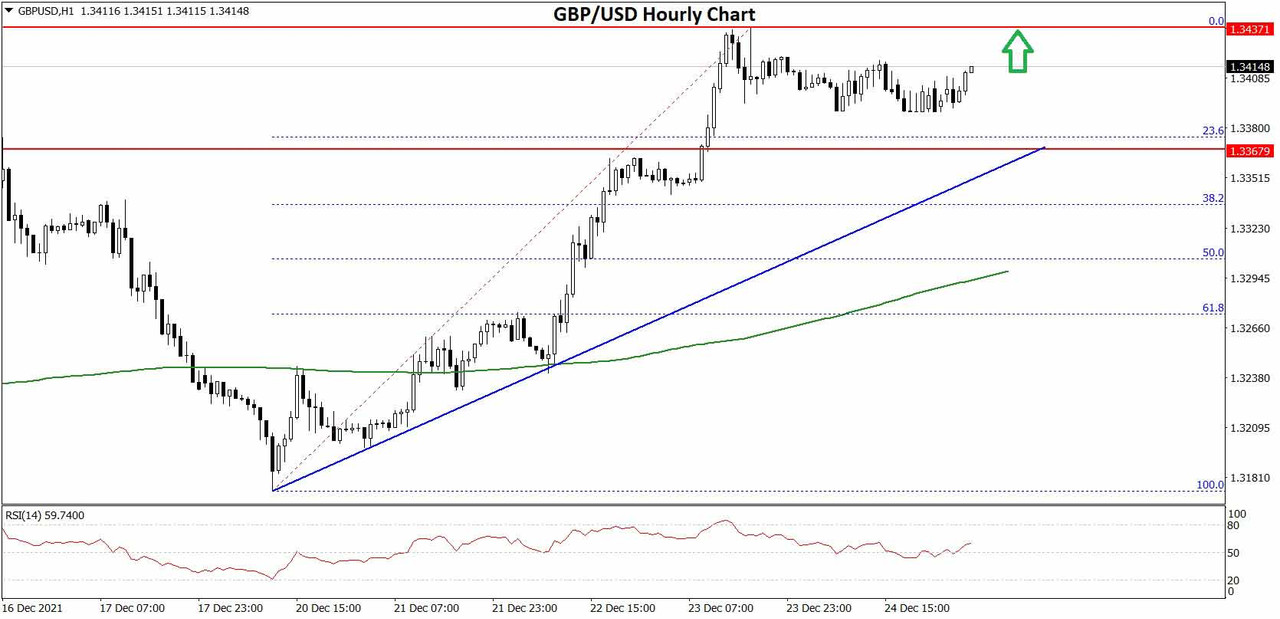

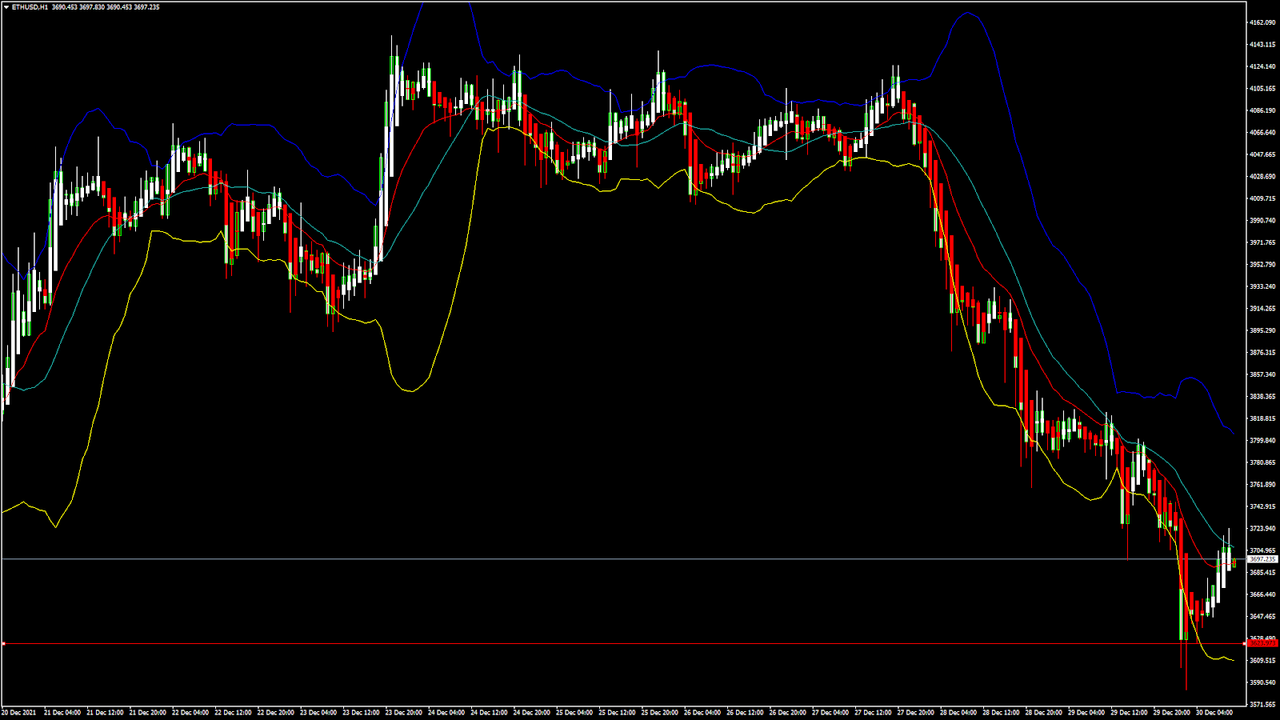

BTCUSD and XRPUSD Technical Analysis – 14th DEC, 2021

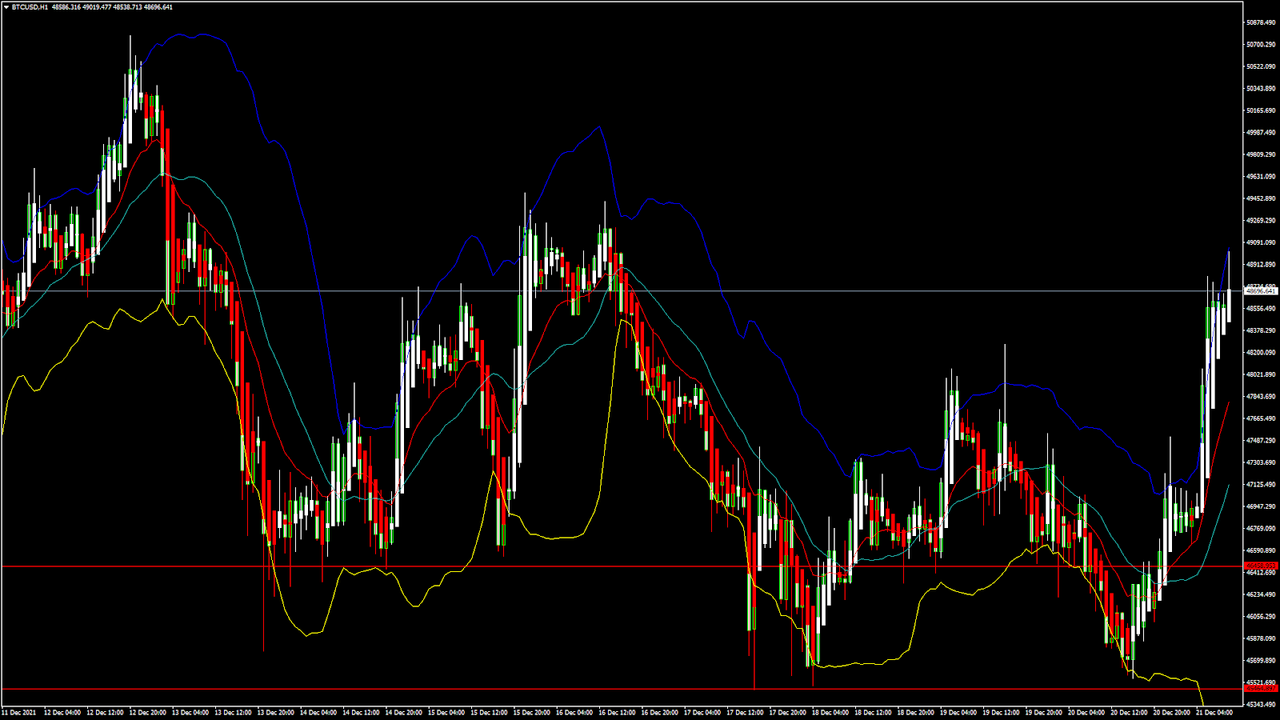

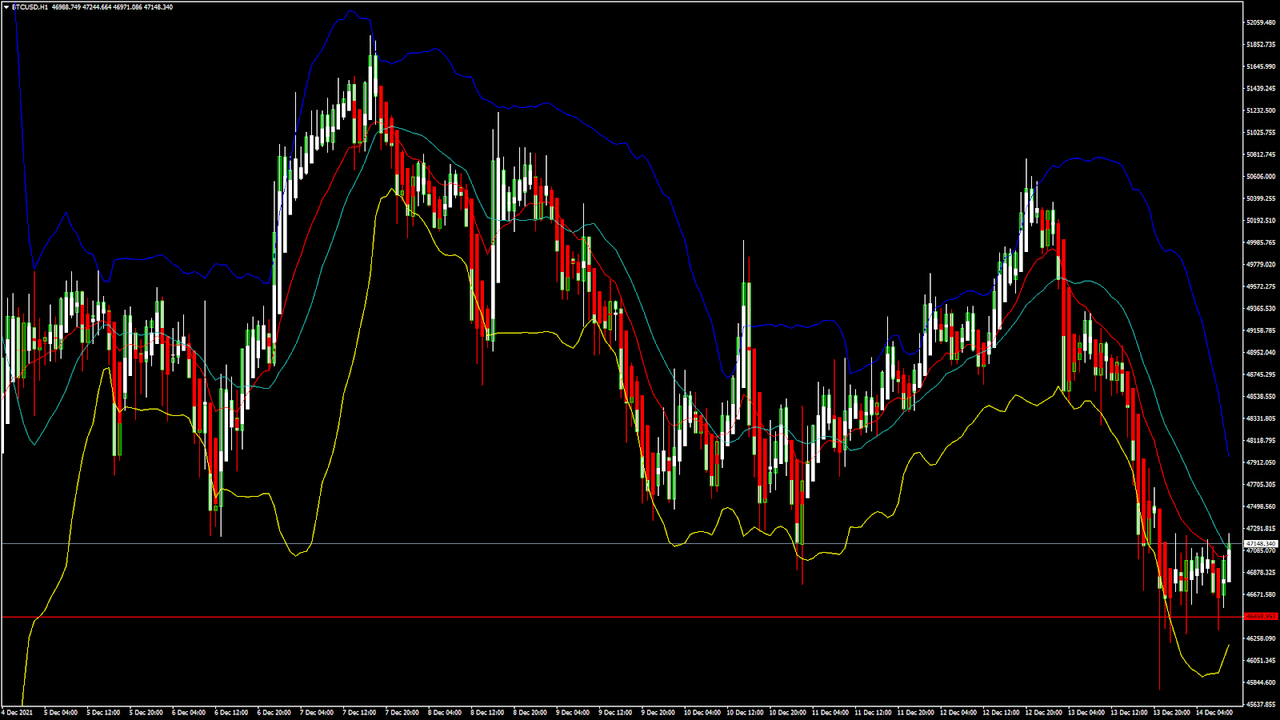

BTCUSD: Head and Shoulders Pattern Below $50,000

Bitcoin was unable to sustain its bullish momentum on 12th Dec and declined after having touched a high of $50,701. We can observe a continuous fall since it touched its all-time high of $59,119 on 30th Nov.

This fall in BTCUSD can also be attributed to the broad-based December selling in crypto markets; this is a time when global investors seem to withdraw their profits and investments due to the upcoming Christmas and New Year holiday season.

In today's European trading session, bitcoin is again back in the bearish channel, trading below the $50,000 handle.

We can clearly see a head-and-shoulders pattern below the $50,000 handle which signifies a fall in the price of Bitcoin and a continuation of the bearish downtrend.

At present, the price of bitcoin has entered a consolidation phase below the $48,000, and this is expected to continue in the US trading session.

Both the Stoch and StochRSI are indicating an OVERBOUGHT level, which means that in the immediate short-term, a decline in the price is expected.

Bitcoin is moving below its both 100 hourly simple and exponential moving averages.

The average true range is indicating a lesser market volatility, which means that markets will be entering a consolidation phase soon.

Bitcoin: Bearish Momentum Below $50,000 Confirmed

BTCUSD is struggling to keep itself above the $50,000 mark, and we can see a mild bullish channel which suggests that a further decline can be expected.

Some of the major technical indicators are giving a SELL signal, which means that the price will fall below $45,000 soon.

In the European trading session, the price of BTCUSD is trading above its classic support level of $46,708 and Fibonacci support level of $46,594.

In the last 24hrs, BTCUSD has gone DOWN by 3.74% with a price change of $1,830, and has a 24hr trading volume of USD 33.547 billion. Compared to yesterday, there was a 41.25% increase in the trading volume. This increase happened thanks to the increased selling pressure, as well as liquidation of bitcoin holdings by investors.

The Week Ahead

Bitcoin continues tumbling down from its Nov 30th all-time high of $59,119. A further decline will push it below the $45,000 handle.

The medium to long-term outlook remains BULLISH for bitcoin, with a target of $55,000. At present, the markets are giving a SELL signal, so it would be best to enter into short positions.

The relative strength index of 42 is indicating a bearish channel, and fresh selling is expected in the markets at any time. This is also due to the renewed fears related to the Omicron coronavirus variant, and many countries shutting down their international borders.

Technical Indicators:

Stoch (9,6): at 98.95 indicating an OVERBOUGHT level

Average directional change (14-day): at 42.60 indicating a SELL

Rate of price change: at -0.837 indicating a SELL

Moving averages convergence divergence (12,26): at -447.70 indicating a SELL

Read Full on FXOpen Company Blog...

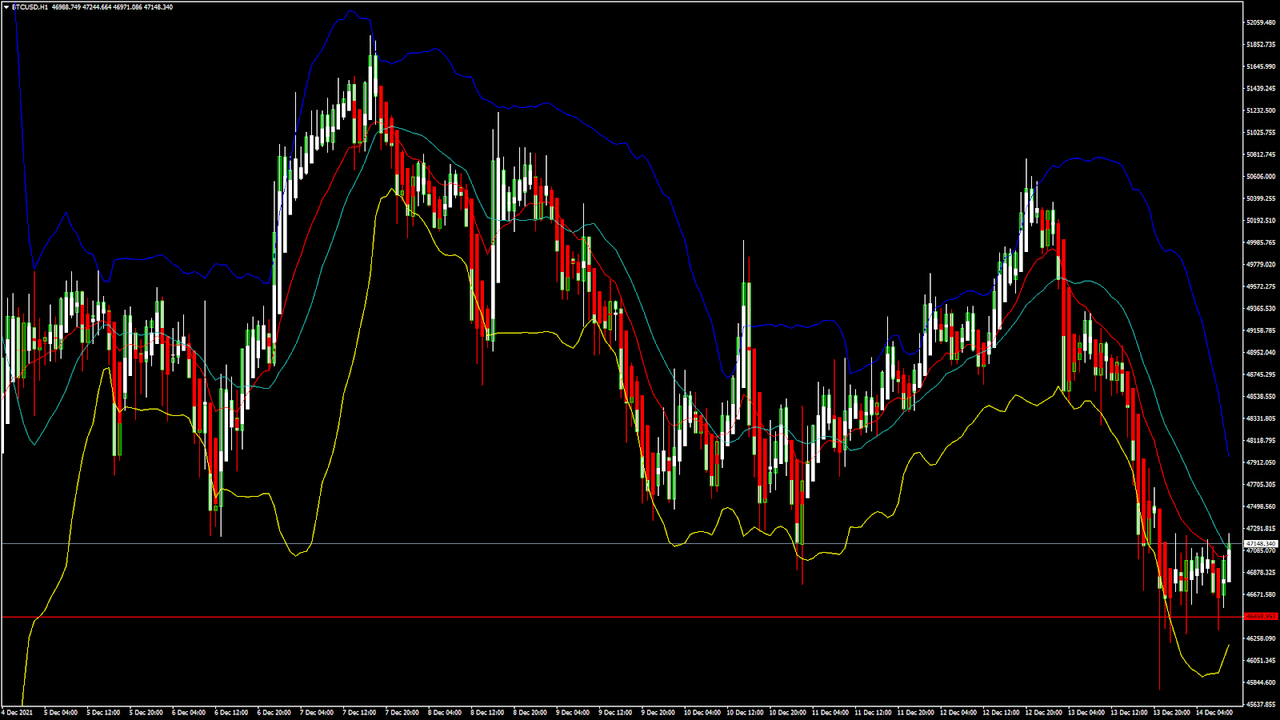

BTCUSD: Head and Shoulders Pattern Below $50,000

Bitcoin was unable to sustain its bullish momentum on 12th Dec and declined after having touched a high of $50,701. We can observe a continuous fall since it touched its all-time high of $59,119 on 30th Nov.

This fall in BTCUSD can also be attributed to the broad-based December selling in crypto markets; this is a time when global investors seem to withdraw their profits and investments due to the upcoming Christmas and New Year holiday season.

In today's European trading session, bitcoin is again back in the bearish channel, trading below the $50,000 handle.

We can clearly see a head-and-shoulders pattern below the $50,000 handle which signifies a fall in the price of Bitcoin and a continuation of the bearish downtrend.

At present, the price of bitcoin has entered a consolidation phase below the $48,000, and this is expected to continue in the US trading session.

Both the Stoch and StochRSI are indicating an OVERBOUGHT level, which means that in the immediate short-term, a decline in the price is expected.

Bitcoin is moving below its both 100 hourly simple and exponential moving averages.

The average true range is indicating a lesser market volatility, which means that markets will be entering a consolidation phase soon.

- Bitcoin trend reversal is seen below $50,000

- Stoch is indicating an OVERBOUGHT level

- The price is now trading just above its pivot level of $46,895

- All the moving averages are giving a SELL signal at current market level of $47,146

Bitcoin: Bearish Momentum Below $50,000 Confirmed

BTCUSD is struggling to keep itself above the $50,000 mark, and we can see a mild bullish channel which suggests that a further decline can be expected.

Some of the major technical indicators are giving a SELL signal, which means that the price will fall below $45,000 soon.

In the European trading session, the price of BTCUSD is trading above its classic support level of $46,708 and Fibonacci support level of $46,594.

In the last 24hrs, BTCUSD has gone DOWN by 3.74% with a price change of $1,830, and has a 24hr trading volume of USD 33.547 billion. Compared to yesterday, there was a 41.25% increase in the trading volume. This increase happened thanks to the increased selling pressure, as well as liquidation of bitcoin holdings by investors.

The Week Ahead

Bitcoin continues tumbling down from its Nov 30th all-time high of $59,119. A further decline will push it below the $45,000 handle.

The medium to long-term outlook remains BULLISH for bitcoin, with a target of $55,000. At present, the markets are giving a SELL signal, so it would be best to enter into short positions.

The relative strength index of 42 is indicating a bearish channel, and fresh selling is expected in the markets at any time. This is also due to the renewed fears related to the Omicron coronavirus variant, and many countries shutting down their international borders.

Technical Indicators:

Stoch (9,6): at 98.95 indicating an OVERBOUGHT level

Average directional change (14-day): at 42.60 indicating a SELL

Rate of price change: at -0.837 indicating a SELL

Moving averages convergence divergence (12,26): at -447.70 indicating a SELL

Read Full on FXOpen Company Blog...