FXOpen Trader

Well-known member

Investors Keep Selling the JPY Despite Falling to the Lowest Since 2002 vs. the US Dollar

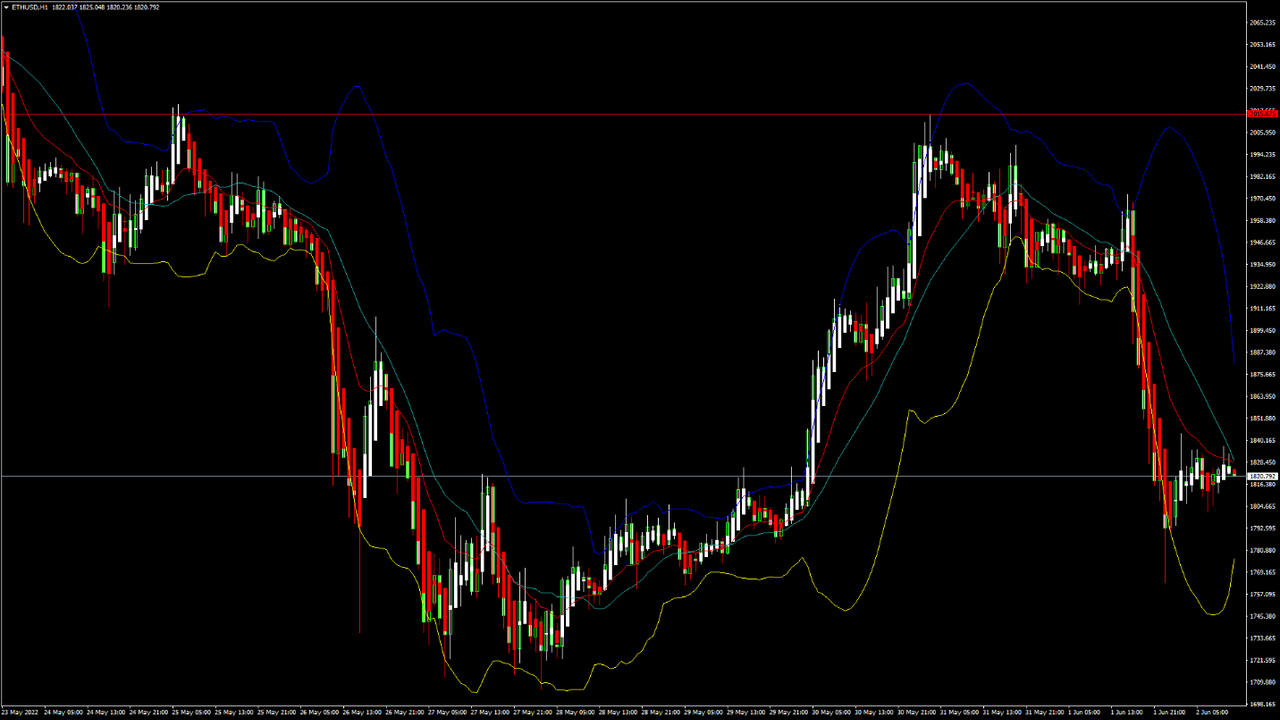

One of the big stories in the FX market in 2022 is the spectacular drop of the Japanese yen (JPY). Since March, it has depreciated against all its peers to reach the weakest levels vs. the US dollar since 2002.

Interestingly enough, the selloff comes when investors had all the reasons to buy the Japanese currency – not to sell it. Historically, the JPY acted as a safe-haven currency.

Effectively, it means that traders bought the JPY and sold US equities in times of uncertainty. Well, one did happen – US stocks are down by about -20% or more, depending on the sector. But the JPY did the opposite.

BOJ’s Measures Put Pressure on the Yen

The trigger of the yen’s weakness was the Bank of Japan’s policy. It continues to suppress bond yields, making JGBs or Japanese Government Bonds less attractive – and the yen too.

This is a central bank that diverges from other major central banks in the sense that it keeps easing conditions while others have started to tighten. The Federal Reserve of the United States is the perfect example, doing exactly the opposite of what the Bank of Japan is doing. Hence, the yen reached the weakest level in more than two decades against the US dollar.

But before blaming it all on the Bank of Japan, one thing should ring a bell for FX traders. If it was only the JPY declining the way it did, then the Bank of Japan was the sole reason for it.

Except it wasn’t.

The other safe-haven currency, the Swiss franc, dropped even more against the US dollar. The USD/CHF exchange rate rose above parity for the first time in many years as investors ran from the so-called safe-haven currencies and bought the US dollar – the world’s reserve currency.

So, what comes next?

Because of the Swiss franc is dropping in a similar or even more aggressive fashion, it means that the price action in the FX market is driven by the US dollar and the Fed and not by the Bank of Japan and the yen. Hence, look for the trend to continue as the move may have just started.

FXOpen Blog

One of the big stories in the FX market in 2022 is the spectacular drop of the Japanese yen (JPY). Since March, it has depreciated against all its peers to reach the weakest levels vs. the US dollar since 2002.

Interestingly enough, the selloff comes when investors had all the reasons to buy the Japanese currency – not to sell it. Historically, the JPY acted as a safe-haven currency.

Effectively, it means that traders bought the JPY and sold US equities in times of uncertainty. Well, one did happen – US stocks are down by about -20% or more, depending on the sector. But the JPY did the opposite.

BOJ’s Measures Put Pressure on the Yen

The trigger of the yen’s weakness was the Bank of Japan’s policy. It continues to suppress bond yields, making JGBs or Japanese Government Bonds less attractive – and the yen too.

This is a central bank that diverges from other major central banks in the sense that it keeps easing conditions while others have started to tighten. The Federal Reserve of the United States is the perfect example, doing exactly the opposite of what the Bank of Japan is doing. Hence, the yen reached the weakest level in more than two decades against the US dollar.

But before blaming it all on the Bank of Japan, one thing should ring a bell for FX traders. If it was only the JPY declining the way it did, then the Bank of Japan was the sole reason for it.

Except it wasn’t.

The other safe-haven currency, the Swiss franc, dropped even more against the US dollar. The USD/CHF exchange rate rose above parity for the first time in many years as investors ran from the so-called safe-haven currencies and bought the US dollar – the world’s reserve currency.

So, what comes next?

Because of the Swiss franc is dropping in a similar or even more aggressive fashion, it means that the price action in the FX market is driven by the US dollar and the Fed and not by the Bank of Japan and the yen. Hence, look for the trend to continue as the move may have just started.

FXOpen Blog