FXOpen Trader

Well-known member

EUR/USD Gains Bearish Momentum While USD/CHF Extends Rally

EUR/USD started a major decline below the 1.0620 level. USD/CHF is rising and might aim more gains above the 0.9450 resistance.

Important Takeaways for EUR/USD and USD/CHF

EUR/USD Technical Analysis

After struggling to clear the 1.0700 resistance, the Euro started a fresh decline against the US Dollar. The EUR/USD pair traded below the 1.0620 support zone to enter a bearish zone.

The pair even declined below the 1.0600 level above the 50 hourly simple moving average. There was also a break below a key bullish trend line with support near 1.0620 on the hourly chart of EUR/USD. The decline gained pace below the 1.0580 level.

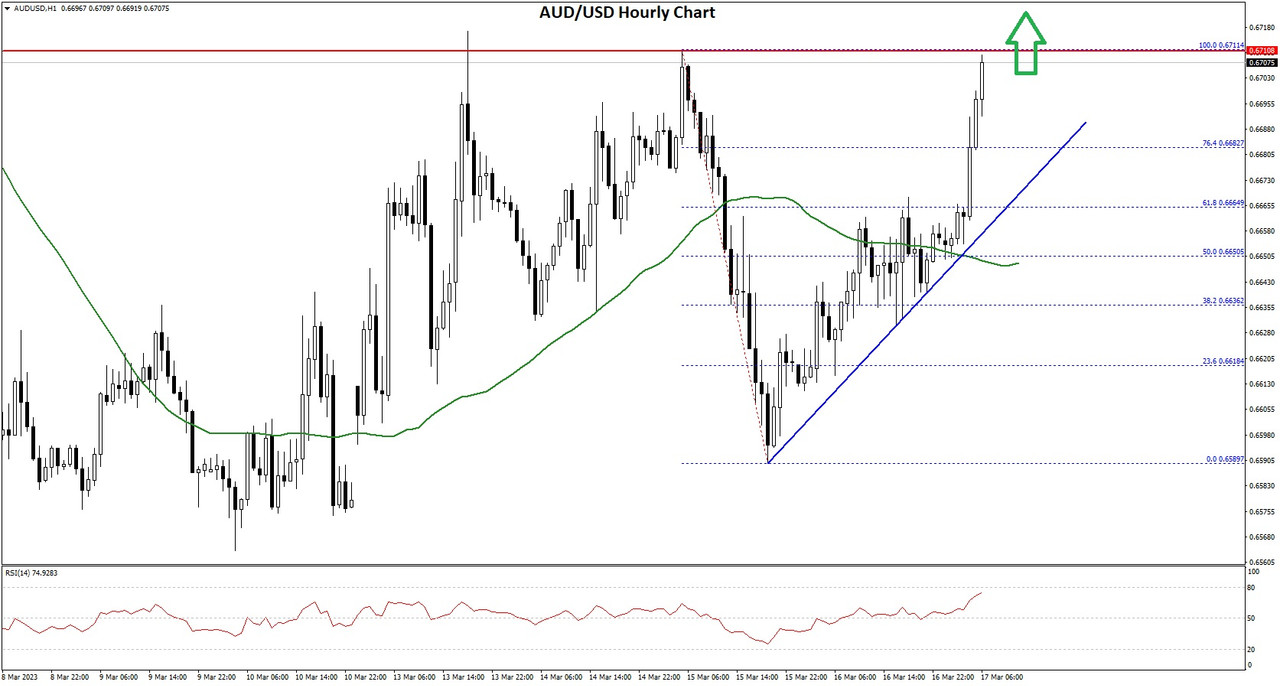

EUR/USD Hourly Chart

A low is formed near 1.0531 on FXOpen and the pair is now showing a lot of bearish signs. An immediate resistance is near the 1.0570 level. It is near the 23.6% Fib retracement level of the downward move from the 1.0694 swing high to 1.0531 low.

The next major resistance is near the 1.0610 level. It is near the 50% Fib retracement level of the downward move from the 1.0694 swing high to 1.0531 low.

A clear move above the 1.0610 resistance zone could send the pair further higher. Any more gains might open the doors for a move towards the 1.0650 level. If there is no recovery, the pair might continue to move down below the 1.0530 level.

On the downside, an immediate support is near the 1.0520 level. The next major support is near the 1.0500 level. A downside break below the 1.0500 support could start steady decline towards the 1.0450 level.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.

EUR/USD started a major decline below the 1.0620 level. USD/CHF is rising and might aim more gains above the 0.9450 resistance.

Important Takeaways for EUR/USD and USD/CHF

- The Euro started a fresh decline from the 1.0700 resistance against the US Dollar.

- There was a break below a key bullish trend line with support near 1.0620 on the hourly chart of EUR/USD.

- USD/CHF started a fresh increase above the 0.9350 resistance zone.

- There was a break above a major bearish trend line with resistance near 0.9315 on the hourly chart.

EUR/USD Technical Analysis

After struggling to clear the 1.0700 resistance, the Euro started a fresh decline against the US Dollar. The EUR/USD pair traded below the 1.0620 support zone to enter a bearish zone.

The pair even declined below the 1.0600 level above the 50 hourly simple moving average. There was also a break below a key bullish trend line with support near 1.0620 on the hourly chart of EUR/USD. The decline gained pace below the 1.0580 level.

EUR/USD Hourly Chart

A low is formed near 1.0531 on FXOpen and the pair is now showing a lot of bearish signs. An immediate resistance is near the 1.0570 level. It is near the 23.6% Fib retracement level of the downward move from the 1.0694 swing high to 1.0531 low.

The next major resistance is near the 1.0610 level. It is near the 50% Fib retracement level of the downward move from the 1.0694 swing high to 1.0531 low.

A clear move above the 1.0610 resistance zone could send the pair further higher. Any more gains might open the doors for a move towards the 1.0650 level. If there is no recovery, the pair might continue to move down below the 1.0530 level.

On the downside, an immediate support is near the 1.0520 level. The next major support is near the 1.0500 level. A downside break below the 1.0500 support could start steady decline towards the 1.0450 level.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.