FXOpen Trader

Well-known member

BTCUSD Analysis: Hammer Pattern above $25,838

Bitcoin price continues its bullish momentum from last week, and after touching a low of $25,838 on May 12, we can see a move towards a consolidation phase, after which we are expecting upsides in the range of $28,500-$29,000.

We can clearly see a hammer pattern above the $25,838 handle on the H1 timeframe.

Bitcoin today continues to move in a consolidation phase, after which we can see upside moves towards the $27,000 handle.

Both the STOCH and Williams's percent range are in overbought zones, which means that in the immediate short term a decline in the price is expected.

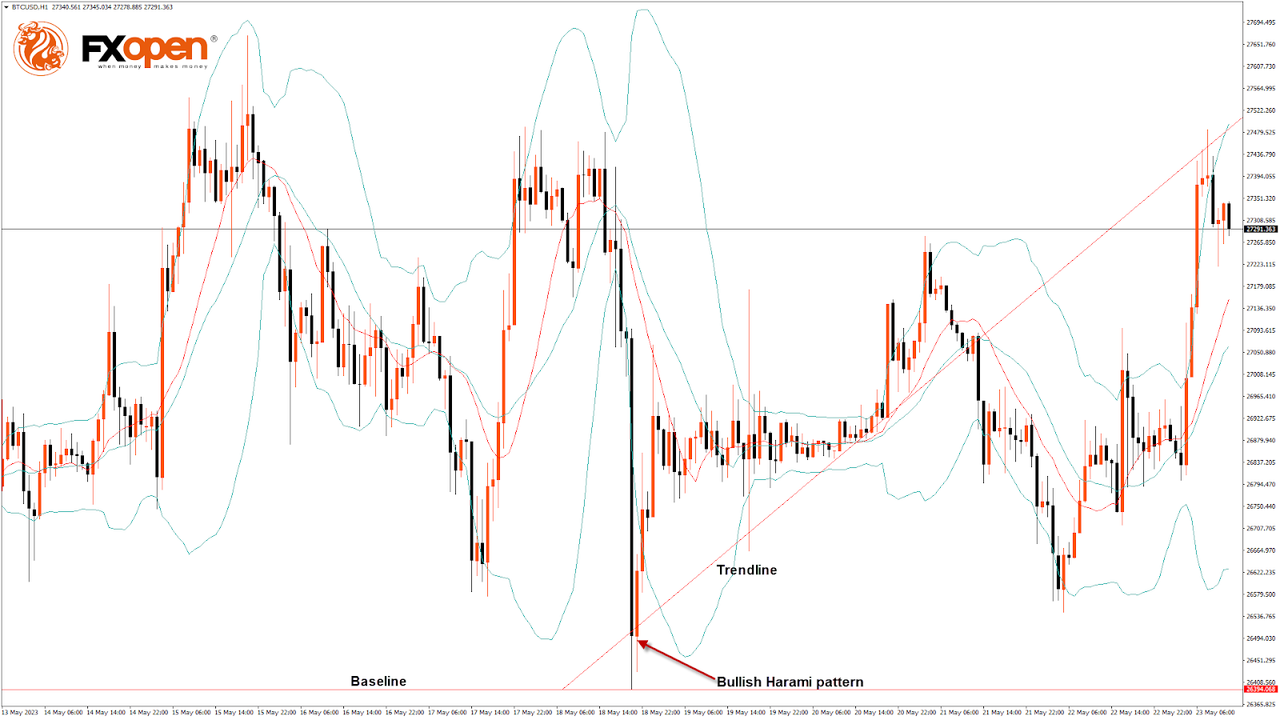

We can also see the formation of a bullish harami pattern in the 15-minute and weekly timeframes.

The relative strength index is at 48.98, indicating a neutral demand for Bitcoin and the continuation of the consolidation in the markets.

Bitcoin price is now moving above its 100-hour simple moving average and its 100-hour exponential moving average.

Most of the major technical indicators are giving a bullish signal, which means that in the immediate short term, we are expecting targets of $27,500 and $28,500.

The average true range indicates low market volatility with mild bullish momentum.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.

Bitcoin price continues its bullish momentum from last week, and after touching a low of $25,838 on May 12, we can see a move towards a consolidation phase, after which we are expecting upsides in the range of $28,500-$29,000.

We can clearly see a hammer pattern above the $25,838 handle on the H1 timeframe.

Bitcoin today continues to move in a consolidation phase, after which we can see upside moves towards the $27,000 handle.

Both the STOCH and Williams's percent range are in overbought zones, which means that in the immediate short term a decline in the price is expected.

We can also see the formation of a bullish harami pattern in the 15-minute and weekly timeframes.

The relative strength index is at 48.98, indicating a neutral demand for Bitcoin and the continuation of the consolidation in the markets.

Bitcoin price is now moving above its 100-hour simple moving average and its 100-hour exponential moving average.

Most of the major technical indicators are giving a bullish signal, which means that in the immediate short term, we are expecting targets of $27,500 and $28,500.

The average true range indicates low market volatility with mild bullish momentum.

- Bitcoin price bullish continuation is seen above $25,838.

- The RSI remains below 50, indicating a neutral market.

- The Bitcoin price is now trading below its pivot level of $27,242.

- The short-term range is mildly bullish.

- Bitcoin price is ranging near the support of the channel and triangle.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.