FXOpen Trader

Well-known member

Rising Yields Put Pressure on the Fed at Wednesday’s Meeting

The main event of the week for financial markets is the Fed’s FOMC meeting on Wednesday. Besides the regular statement, the Fed will reveal its economic projections, and the market will focus on the dots plot that shows the federal funds rate forecast for the next three years.

The event is particularly important for traders because the dollar is at crossroads. If the Fed signals a liftoff before 2024, the markets will take it as a hawkish signal that would trigger a wave of dollar buying. On the other hand, if the dots plot do not show any increase until 2024, the Fed signals its willingness to keep accommodative conditions despite the recent fiscal stimulus.

Challenges for the Fed

The big challenge for the Fed comes from the long-term yields, which rose recently. While the move higher is insignificant on the long-term charts, it does signal an unwanted tightening of financial conditions.

Moreover, the move higher in the yields generated a dollar rally at the end of February, tempered only by the new round of fiscal stimulus from Biden’s administration. Should the yields rise further, the investors may turn their attention to the dollar again. Yields typically rise during the economic recovery, and the new fiscal stimulus package leads to faster recovery.

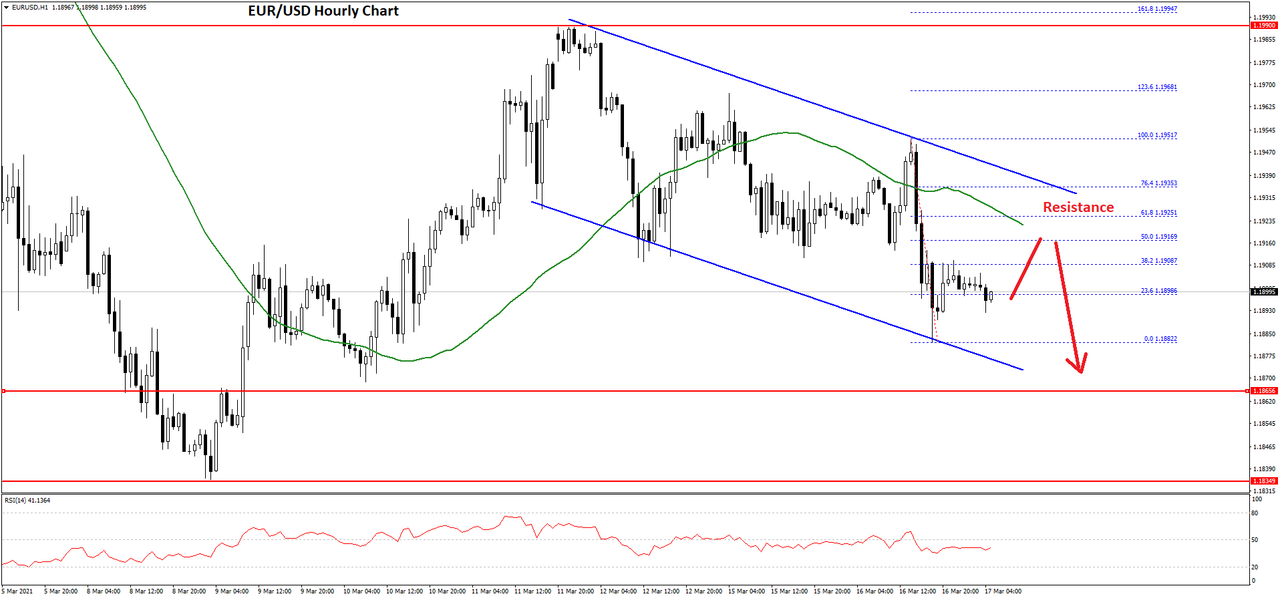

Ahead of Wednesday’s meeting, the dollar remains offered – the EURUSD is back above 1.19, the AUDUSD is above 0.77, and the GBPUSD trades close to 1.40. If the Fed hints at no rate hike until 2024, the dollar may take another dive. On the other hand, if the Fed is pressured by the rising yields and hints at a rate hike as early as 2023, the dollar may rally, sending the EURUSD below its recent 1.1840 support.

All in all, traders are guaranteed to see high volatility and quick price action as the Fed unveils its economic projections.

FXOpen Blog

The main event of the week for financial markets is the Fed’s FOMC meeting on Wednesday. Besides the regular statement, the Fed will reveal its economic projections, and the market will focus on the dots plot that shows the federal funds rate forecast for the next three years.

The event is particularly important for traders because the dollar is at crossroads. If the Fed signals a liftoff before 2024, the markets will take it as a hawkish signal that would trigger a wave of dollar buying. On the other hand, if the dots plot do not show any increase until 2024, the Fed signals its willingness to keep accommodative conditions despite the recent fiscal stimulus.

Challenges for the Fed

The big challenge for the Fed comes from the long-term yields, which rose recently. While the move higher is insignificant on the long-term charts, it does signal an unwanted tightening of financial conditions.

Moreover, the move higher in the yields generated a dollar rally at the end of February, tempered only by the new round of fiscal stimulus from Biden’s administration. Should the yields rise further, the investors may turn their attention to the dollar again. Yields typically rise during the economic recovery, and the new fiscal stimulus package leads to faster recovery.

Ahead of Wednesday’s meeting, the dollar remains offered – the EURUSD is back above 1.19, the AUDUSD is above 0.77, and the GBPUSD trades close to 1.40. If the Fed hints at no rate hike until 2024, the dollar may take another dive. On the other hand, if the Fed is pressured by the rising yields and hints at a rate hike as early as 2023, the dollar may rally, sending the EURUSD below its recent 1.1840 support.

All in all, traders are guaranteed to see high volatility and quick price action as the Fed unveils its economic projections.

FXOpen Blog