Capitalcore

Well-known member

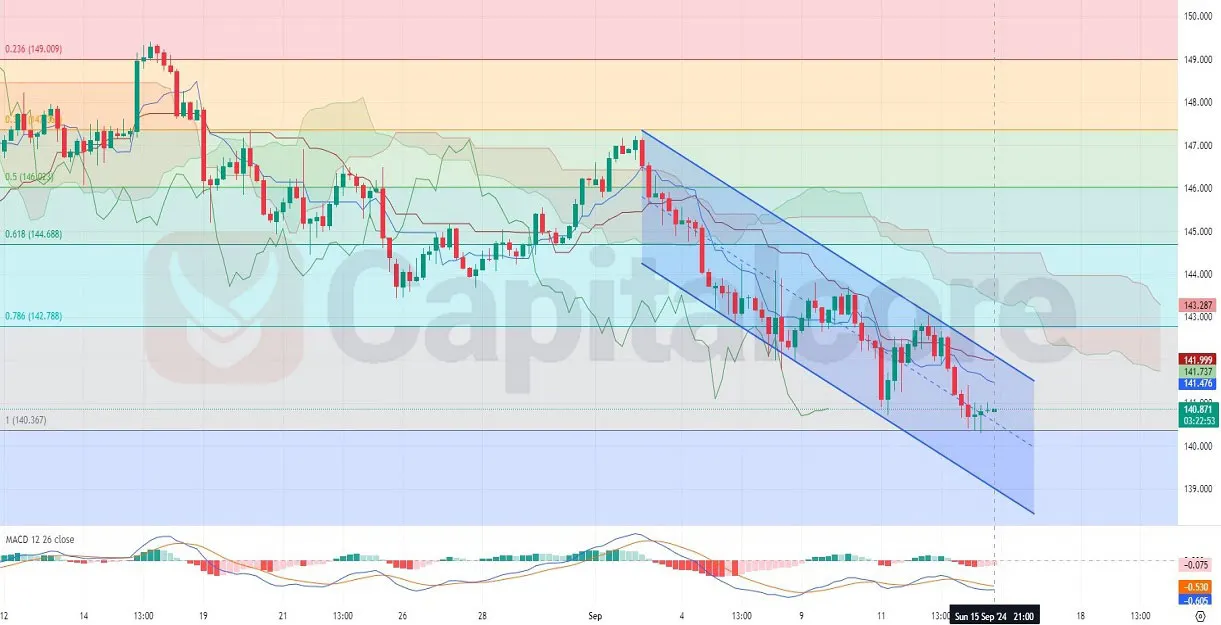

USDJPY bearish trend continues on H4 chart

USD/JPY forex pair, also known as the "Gopher," is one of the most traded forex pairs globally, reflecting the relationship between the U.S. dollar and the Japanese yen. The pair is highly sensitive to market sentiment, risk appetite, and economic developments in both the U.S. and Japan. Today’s economic landscape is shaped by the upcoming release of the New York Manufacturing Index from the U.S., which serves as a leading indicator of economic health. If the actual index is higher than forecasted, it will support the dollar, signaling improving business conditions. However, due to the closure of Japanese banks for Respect-for-the-Aged Day, market liquidity could be low, leading to irregular volatility and a higher influence of speculators.

Chart Notes:

• Chart time-zone is UTC (+03:00)

• Candles’ time-frame is 4h.

Analyzing the USD/JPY H4 chart, the price is currently trading below the Ichimoku cloud, indicating bearish momentum. The cloud has widened, suggesting the potential for a stronger downtrend, though the last four candles show a slight bullish correction. The price is fluctuating between the 0.786 and 1 Fibonacci levels, having corrected slightly after touching the 1 level. The MACD shows a weak bullish divergence, but the histogram remains negative, signaling that any bullish momentum may be short-lived. Overall, the trend remains bearish, and further declines are expected after this minor correction.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.

Capitalcore

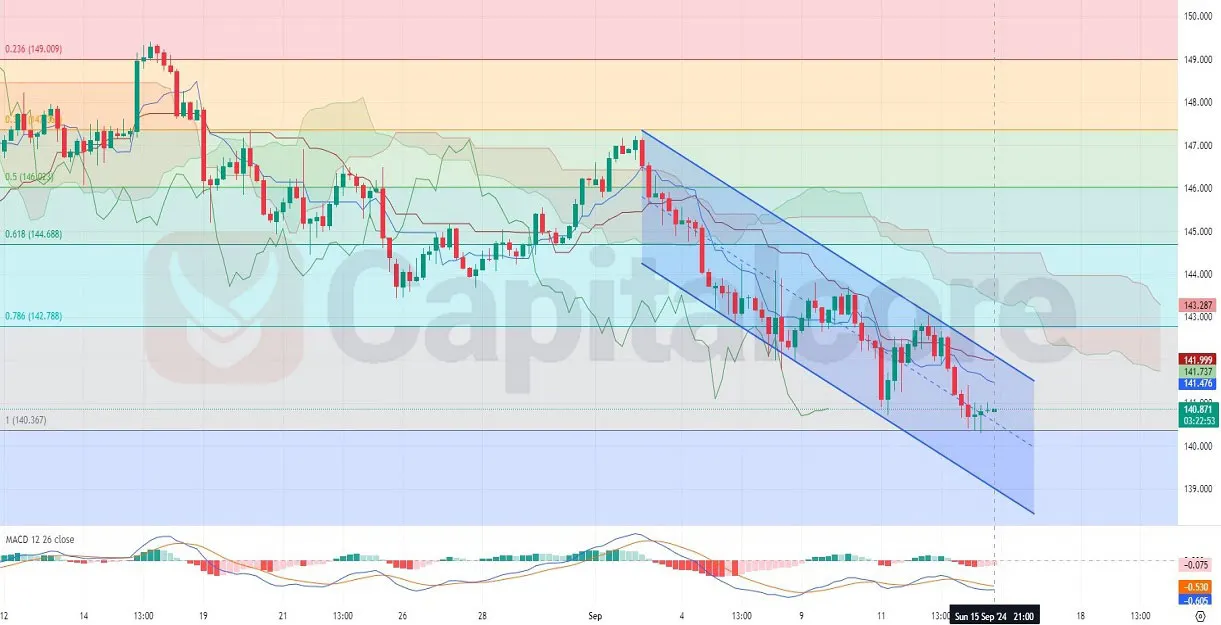

USD/JPY forex pair, also known as the "Gopher," is one of the most traded forex pairs globally, reflecting the relationship between the U.S. dollar and the Japanese yen. The pair is highly sensitive to market sentiment, risk appetite, and economic developments in both the U.S. and Japan. Today’s economic landscape is shaped by the upcoming release of the New York Manufacturing Index from the U.S., which serves as a leading indicator of economic health. If the actual index is higher than forecasted, it will support the dollar, signaling improving business conditions. However, due to the closure of Japanese banks for Respect-for-the-Aged Day, market liquidity could be low, leading to irregular volatility and a higher influence of speculators.

Chart Notes:

• Chart time-zone is UTC (+03:00)

• Candles’ time-frame is 4h.

Analyzing the USD/JPY H4 chart, the price is currently trading below the Ichimoku cloud, indicating bearish momentum. The cloud has widened, suggesting the potential for a stronger downtrend, though the last four candles show a slight bullish correction. The price is fluctuating between the 0.786 and 1 Fibonacci levels, having corrected slightly after touching the 1 level. The MACD shows a weak bullish divergence, but the histogram remains negative, signaling that any bullish momentum may be short-lived. Overall, the trend remains bearish, and further declines are expected after this minor correction.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.

Capitalcore