FXOpen Trader

Well-known member

EUR/USD and EUR/JPY: Euro Eyes Recovery

EUR/USD extended its decline to 1.1565 before correcting higher. EUR/JPY is rising, but it is facing hurdles near 129.50 and 129.75.

Important Takeaways for EUR/USD and EUR/JPY

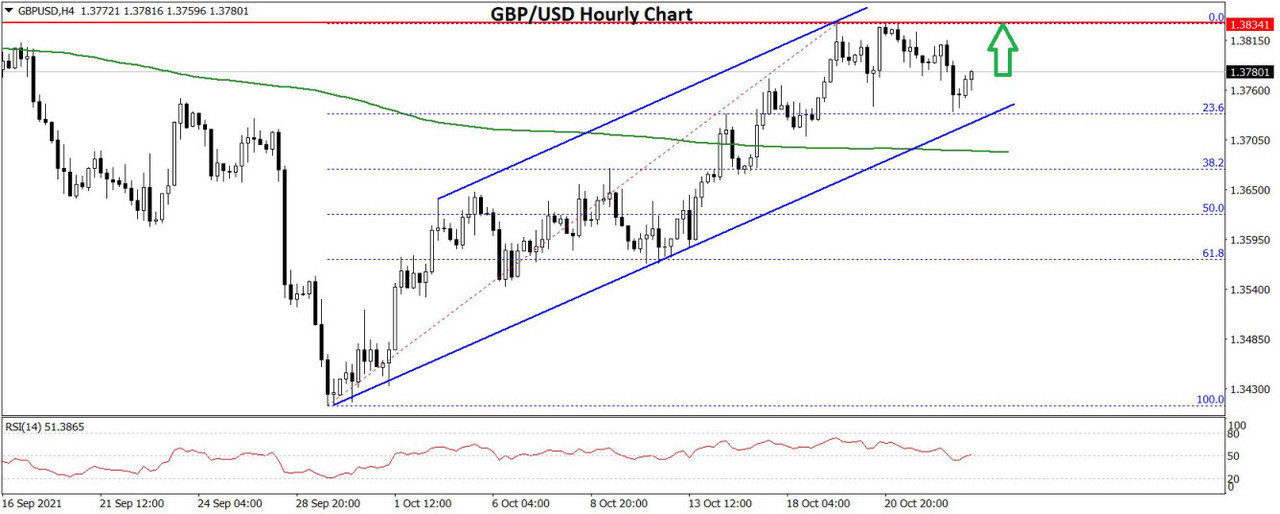

EUR/USD Technical Analysis

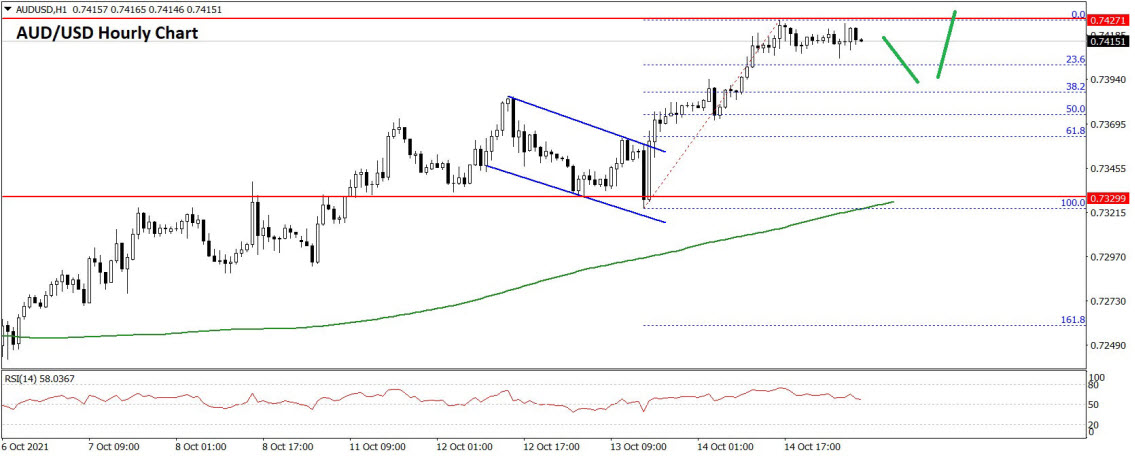

The Euro started a major decline after it struggled to clear the 1.1750 resistance against the US Dollar. The EUR/USD pair broke the 1.1650 support zone to move into a bearish zone.

The pair even traded below the 1.1600 support and settled below the 50 hourly simple moving average. A low was formed near 1.1563 on FXOpen and the pair is now correcting losses. There was a break above the 1.1600 level.

EUR/USD Hourly Chart

The pair even spiked above the 1.1620 resistance level, but it faced a strong resistance near the 1.1640 level. A high was formed near 1.1639 and the pair corrected lower.

It traded below the 50% Fib retracement level of the upward move from the 1.1563 swing low to 1.1639 high. There is also a major bearish trend line forming with resistance near 1.1600 on the hourly chart.

It is now consolidating near the 1.1590 level and below the 50 hourly simple moving average. An immediate resistance is near the 1.1600 level. The main resistance is forming near the 1.1640 and 1.1650 levels. A clear break above the 1.1650 resistance could push EUR/USD towards 1.1750.

On the downside, the 1.1665 level is a major support. Any more losses might lead EUR/USD towards the 1.1520 support zone in the near term. The next major support sits near the 1.1500 level.

EUR/USD extended its decline to 1.1565 before correcting higher. EUR/JPY is rising, but it is facing hurdles near 129.50 and 129.75.

Important Takeaways for EUR/USD and EUR/JPY

- The Euro gained bearish momentum below 1.1650 and 1.1600.

- There is a major bearish trend line forming with resistance near 1.1600 on the hourly chart.

- EUR/JPY is attempting a recovery wave above the 129.20 resistance level.

- There is a key bullish trend line forming with support near 129.00 on the hourly chart.

EUR/USD Technical Analysis

The Euro started a major decline after it struggled to clear the 1.1750 resistance against the US Dollar. The EUR/USD pair broke the 1.1650 support zone to move into a bearish zone.

The pair even traded below the 1.1600 support and settled below the 50 hourly simple moving average. A low was formed near 1.1563 on FXOpen and the pair is now correcting losses. There was a break above the 1.1600 level.

EUR/USD Hourly Chart

The pair even spiked above the 1.1620 resistance level, but it faced a strong resistance near the 1.1640 level. A high was formed near 1.1639 and the pair corrected lower.

It traded below the 50% Fib retracement level of the upward move from the 1.1563 swing low to 1.1639 high. There is also a major bearish trend line forming with resistance near 1.1600 on the hourly chart.

It is now consolidating near the 1.1590 level and below the 50 hourly simple moving average. An immediate resistance is near the 1.1600 level. The main resistance is forming near the 1.1640 and 1.1650 levels. A clear break above the 1.1650 resistance could push EUR/USD towards 1.1750.

On the downside, the 1.1665 level is a major support. Any more losses might lead EUR/USD towards the 1.1520 support zone in the near term. The next major support sits near the 1.1500 level.