FXOpen Trader

Well-known member

EUR/USD and EUR/JPY: Euro Eyes Fresh Increase

EUR/USD struggled to clear 1.2200 and recently corrected lower. EUR/JPY is trading in a positive zone, but it must clear 133.70 for more upsides.

Important Takeaways for EUR/USD and EUR/JPY

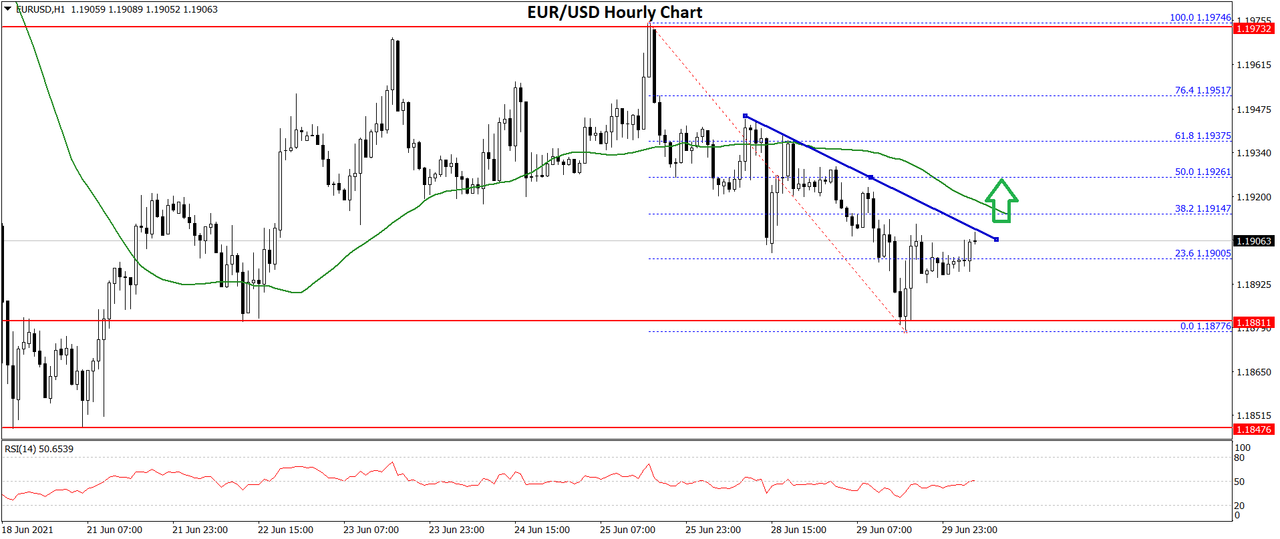

EUR/USD Technical Analysis

The Euro started a fresh decline from the 1.2200 resistance zone against the US Dollar. The EUR/USD pair broke the 1.2150 and 1.2120 support levels to move into a short-term bearish zone.

The pair even settled well below 1.2150 and the 50 hourly simple moving average. A low was formed near 1.2092 on FXOpen and the pair is now correcting losses. There was a break above the 1.2120 resistance level and the 50 hourly SMA.

There was also a break above the 23.6% Fib retracement level of the recent drop from the 1.2192 high to 1.2092 low. The pair is now facing a strong resistance near the 1.2140 and 1.2150 levels.

There is also a key bearish trend line forming with resistance near 1.2142 on the hourly chart. The trend line is close to the 50% Fib retracement level of the recent drop from the 1.2192 high to 1.2092 low. A proper break above the trend line resistance could pop the pair higher towards the 1.2200 resistance zone.

The next major resistance is near the 1.2220 level. Any more gains could set the pace for a fresh high above the 1.2150 level in the near term. On the downside, an immediate support is near the 1.2100 level.

If there is a downside break, EUR/USD might continue to move down towards the 1.2060 support. Any more losses could open the doors for a test of the 1.2020 support region.

Read Full on FXOpen Company Blog...

EUR/USD struggled to clear 1.2200 and recently corrected lower. EUR/JPY is trading in a positive zone, but it must clear 133.70 for more upsides.

Important Takeaways for EUR/USD and EUR/JPY

- The Euro declined below the 1.2150 and 1.2120 support levels, and tested 1.2100.

- There is a key bearish trend line forming with resistance near 1.2142 on the hourly chart.

- EUR/JPY gained pace after it broke the 132.80 and 133.00 resistance levels.

- There was a break above a major bearish trend line with resistance near 132.90 on the hourly chart.

EUR/USD Technical Analysis

The Euro started a fresh decline from the 1.2200 resistance zone against the US Dollar. The EUR/USD pair broke the 1.2150 and 1.2120 support levels to move into a short-term bearish zone.

The pair even settled well below 1.2150 and the 50 hourly simple moving average. A low was formed near 1.2092 on FXOpen and the pair is now correcting losses. There was a break above the 1.2120 resistance level and the 50 hourly SMA.

There was also a break above the 23.6% Fib retracement level of the recent drop from the 1.2192 high to 1.2092 low. The pair is now facing a strong resistance near the 1.2140 and 1.2150 levels.

There is also a key bearish trend line forming with resistance near 1.2142 on the hourly chart. The trend line is close to the 50% Fib retracement level of the recent drop from the 1.2192 high to 1.2092 low. A proper break above the trend line resistance could pop the pair higher towards the 1.2200 resistance zone.

The next major resistance is near the 1.2220 level. Any more gains could set the pace for a fresh high above the 1.2150 level in the near term. On the downside, an immediate support is near the 1.2100 level.

If there is a downside break, EUR/USD might continue to move down towards the 1.2060 support. Any more losses could open the doors for a test of the 1.2020 support region.

Read Full on FXOpen Company Blog...